Congress is about to prohibit the Internal Revenue Service from providing free tax preparation software that could save American taxpayers millions of dollars from wasting their money on tax services like Turbo-Tax and H&R Block.

ProPublica reported that the House Ways and Means Committee passed the Taxpayer First Act last week on a bipartisan basis.

The bill is sponsored in the house through Democratic Rep. John Lewis (GA) and Republican Mike Kelly (PA); and in the senate Finance Committee Chair Chuck Grassley (R-IA) and Ron Wyden (D-OR).

One of the provisions of the bill would make it illegal for the IRS to create its own online tax preparation system.

If the IRS created their own system like most other developed countries, critics argue it would threaten the industry's profits.

Mandi Matlock, a tax attorney who works for the National Consumer Law Center is deeply concerned.

"This could be a disaster. It could be the final nail in the coffin of the idea of the IRS ever being able to create its own program."

The CCN expects the bill could be successful compared to past efforts since it includes other provisions benefiting "both sides of the aisle."

"For example, the Act will prevent the IRS from using private debt collection agencies on people who owe under a certain amount."

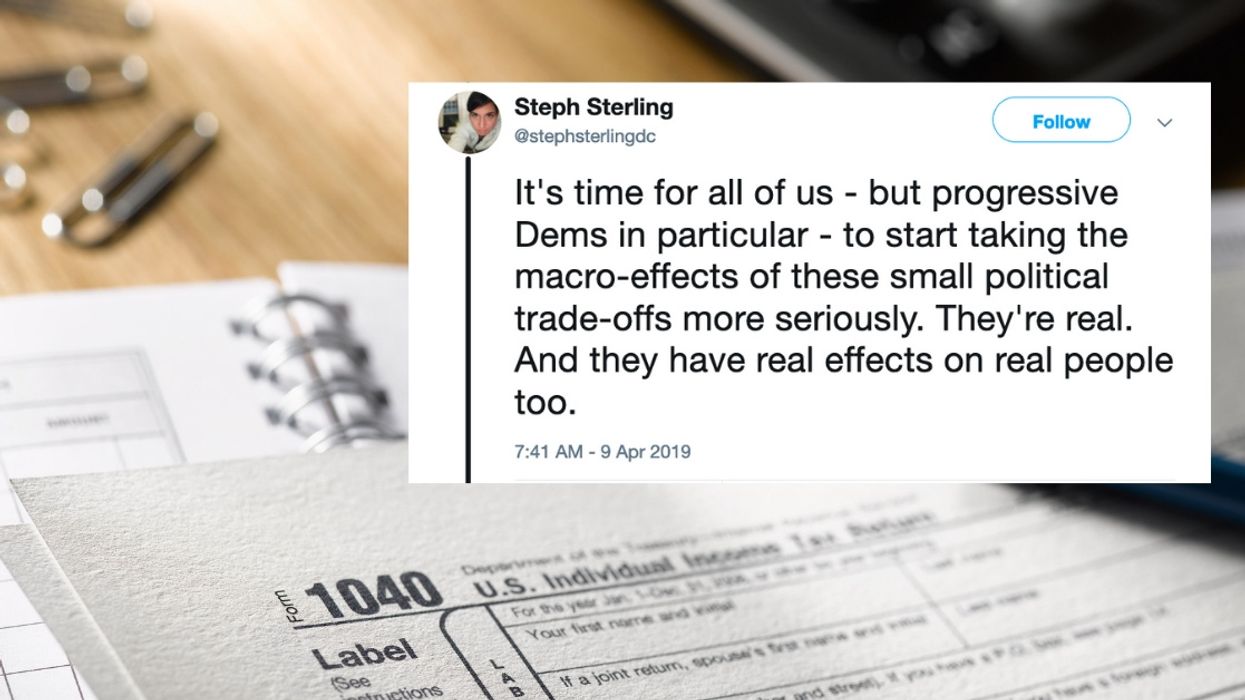

Steph Sterling weighed in with his observations about ProPublica's article on the Taxpayer First Act.

The Free File Alliance, a private industry group, reported that 70% of Americans who make under $66,000 can file their taxes for free through free tax software provided by private companies.

But only 3% of qualified taxpayers file for free because most are unaware of their eligibility.

ProPublica explained about the pitfalls of free filing through private tax accounting software firms:

"Critics of the program say that companies use it as a cross-marketing tool to upsell paid products, that they have deliberately underpromoted the free option and that it leaves consumer data open to privacy breaches."

"The congressional move would codify the status quo. Under an existing memorandum of understanding with the industry group, the IRS pledges not to create its own online filing system and, in exchange, the companies offer their free filing services to those below the income threshold."

Some countries like Denmark, Sweden, Estonia, Chile, and Spain even offer pre-populated returns.

People living in the United Kingdom, Germany, and Japan don't have to file taxes at all since they "have exact enough tax withholding procedures," according to Vox.

International taxpayers revealed their contrasting filing methods through state-run, free electronic systems.

According to Fortune, Free File Alliance member Blucora expressed their concern over the threat of private options with a 2017 10-K filing with the U.S. Securities and Exchange Commission.

Blucora said it faces:

"the risk of federal and state taxing authorities developing software or other systems to facilitate tax return preparation and electronic filing at no charge to taxpayers, which could reduce the need for TaxAct's software and services. These or similar programs may be introduced or expanded in the future, which may cause us to lose customers and revenue."

The IRS's current agreement with Free File Alliance is set to expire in October 2021.

@valkilmerofficial/Instagram

@valkilmerofficial/Instagram @valkilmerofficial/Instagram

@valkilmerofficial/Instagram @valkilmerofficial/Instagram

@valkilmerofficial/Instagram @valkilmerofficial/Instagram

@valkilmerofficial/Instagram @valkilmerofficial/Instagram

@valkilmerofficial/Instagram @valkilmerofficial/Instagram

@valkilmerofficial/Instagram @valkilmerofficial/Instagram

@valkilmerofficial/Instagram @valkilmerofficial/Instagram

@valkilmerofficial/Instagram

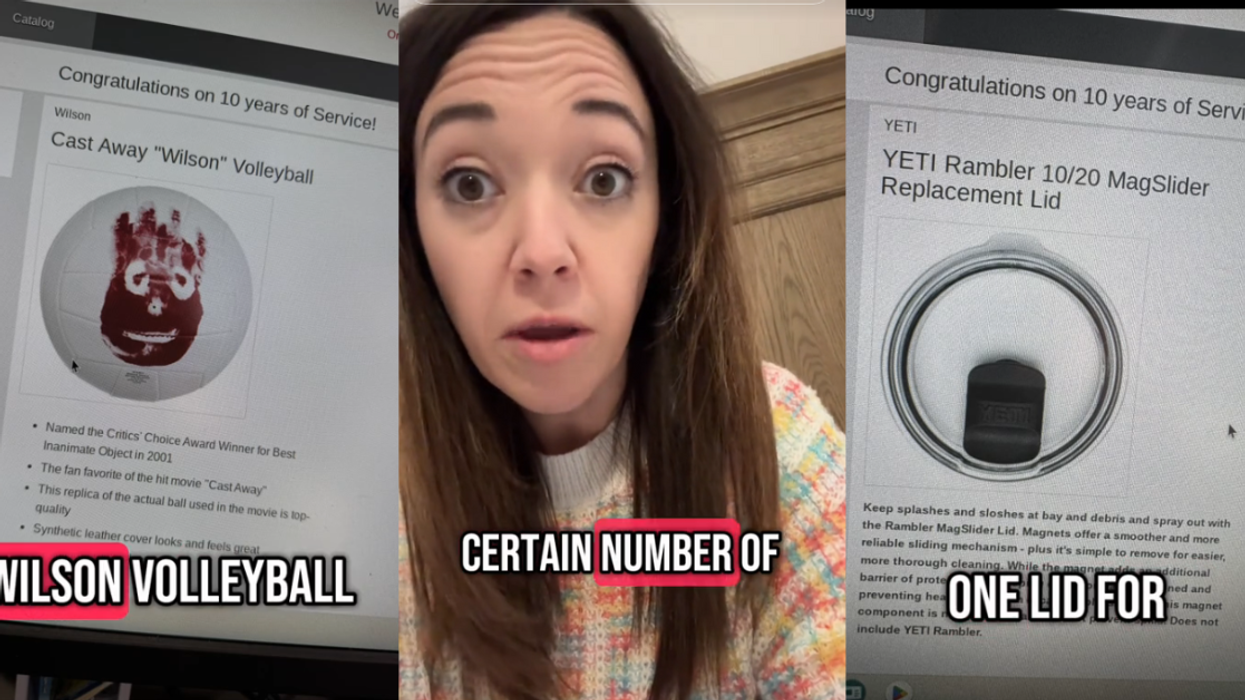

@youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok @youtube.podcast.rewind/TikTok

@youtube.podcast.rewind/TikTok

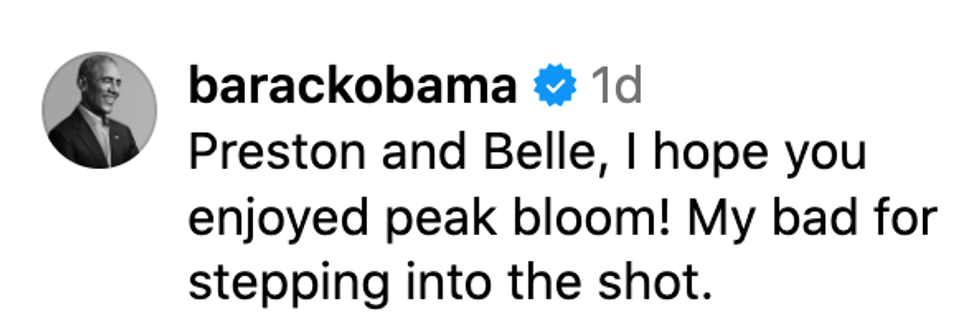

@barackobama/Instagram

@barackobama/Instagram @casouthernbell/Instagram

@casouthernbell/Instagram @jnjmommy_/Instagram

@jnjmommy_/Instagram @a_noor333/Instagram

@a_noor333/Instagram @lo.nicole_/Instagram

@lo.nicole_/Instagram @anown11/TikTok

@anown11/TikTok @amandavk/Instagram

@amandavk/Instagram @sunflowerchild2402/TikTok

@sunflowerchild2402/TikTok @jchurchie223/TikTok

@jchurchie223/TikTok @practicallyours/Instagram

@practicallyours/Instagram @g.h.o.n.c..h.e.h/Instagram

@g.h.o.n.c..h.e.h/Instagram @tru1lykust0m/Instagram

@tru1lykust0m/Instagram @briashmurph/TikTok

@briashmurph/TikTok