Now that 2018 is behind us, Tax Day on April 15 will be here before you know it. However, your refund might not be as punctual.

The protracted partial government shutdown's rippling effect could drag on indefinitely. Donald Trump, who refused to accept anything less than $5.6 billion for funding his border wall, told congressional leaders on Friday that the shutdown could last "months or even years," according to the Washington Post.

That would not bode well for the early tax filers who are needing the money they are owed most.

Business Insider reported there is a possibility taxpayers will not be affected if the shutdown is resolved in the next few weeks; however, the current situation could cause a delay for those who file early when the IRS begins processing tax returns at the end of January.

Basically, Trump is withholding your money until he has the funds to fulfill his crippling campaign promise.

Richard Rubin of the Wall Street Journal reported there would be "billions of dollars in income-tax refunds" in limbo if the shutdown persists.

Presently, the Internal Revenue Service is chugging along on 12.5%, or fewer than10,000 federal employees, and is unable to run audits, answer off-season taxpayer questions, and issue refunds during the shutdown.

An undisclosed contingency plan is underway if the impasse between Congress and the President lingers.

Rubin elaborated:

"For many Americans, the tax refund is the single largest financial event of the year, and the people who tend to file early in the season are taxpayers who count on large refunds to pay down debt, catch up on bills or make major purchases."

"Those are disproportionately low-income households that benefit from the earned-income tax credit and other provisions that give them no income-tax liability or a net benefit from the income-tax system."

Insider noted that the political standoff comes after the 2018 approval of the new GOP tax law in which American taxpayers were expecting a hefty refund check this spring.

The Union Bank of Switzerland (USB) analysts said that married filers with two children would benefit from bigger tax returns. The overall estimate under the new tax law would generate an increase between $42 billion and $66 billion, up from the 2017 tax year.

The Treasury Inspector General for Tax Administration had already issued a warning on September 2018 about the risk of a delayed filing start for 2019.

According to CNN, Kyle Pomerleau – an economist at the Tax Foundation – admitted the current deadlock "does throw a little bit of wrench into things" and noted that any delay will have a negative impact on those relying on an early return.

"This filing season was always going to be challenging. The IRS was still figuring that out. Individuals were still figuring that out even with the full funding."

Tax payers expressed the fairness of filing late – or not at all – in response to the possible delay.

The endgame is even more terrifying.

The solution seems simple enough.

Unless Congress could override Trump's veto of the clean funding bill or if there is a concession from Democrats and the White House, as suggested by the Washington Post, the extended shutdown will continue creating headaches.

Here's hoping for a miracle.

@mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok @mstarland/TikTok

@mstarland/TikTok

@poorandhungry/TikTok

@poorandhungry/TikTok @poorandhungry/TikTok

@poorandhungry/TikTok @poorandhungry/TikTok

@poorandhungry/TikTok @poorandhungry/TikTok

@poorandhungry/TikTok @poorandhungry/TikTok

@poorandhungry/TikTok @poorandhungry/TikTok

@poorandhungry/TikTok @poorandhungry/TikTok

@poorandhungry/TikTok @poorandhungry/TikTok

@poorandhungry/TikTok @poorandhungry/TikTok

@poorandhungry/TikTok @poorandhungry/TikTok

@poorandhungry/TikTok @poorandhungry/TikTok

@poorandhungry/TikTok

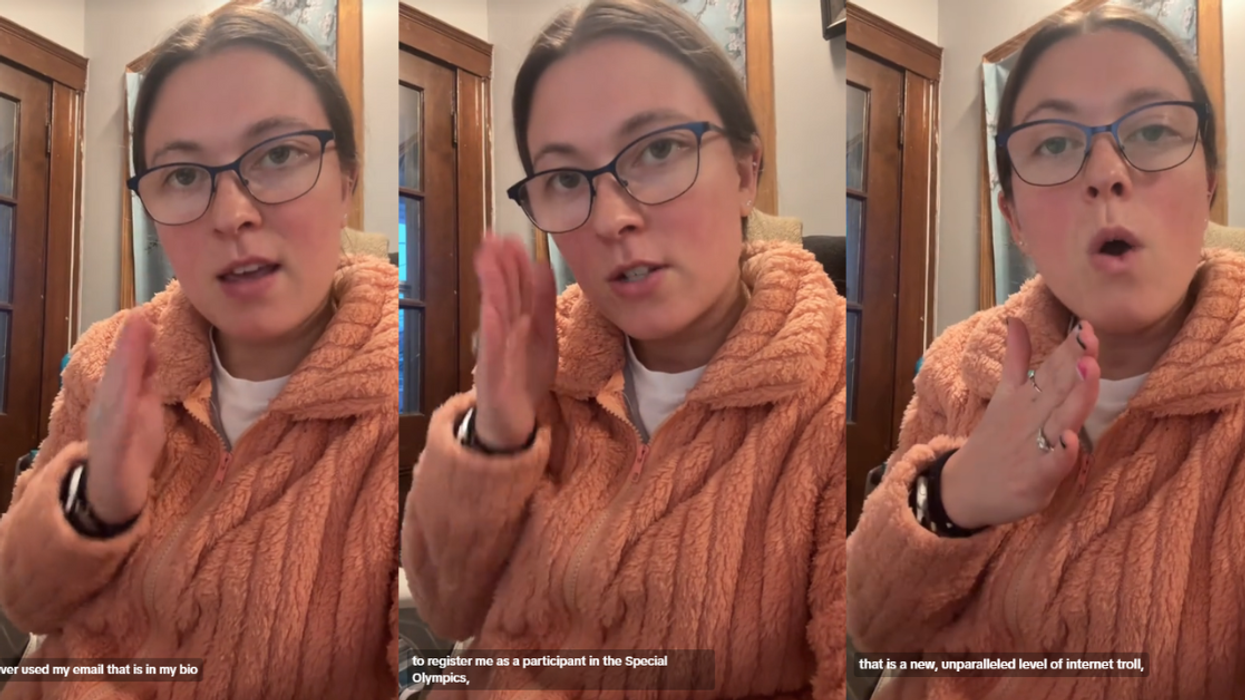

@myriamestrella8/TikTok

@myriamestrella8/TikTok @myriamestrella8/TikTok

@myriamestrella8/TikTok @myriamestrella8/TikTok

@myriamestrella8/TikTok @myriamestrella8/TikTok

@myriamestrella8/TikTok @myriamestrella8/TikTok

@myriamestrella8/TikTok @myriamestrella8/TikTok

@myriamestrella8/TikTok @myriamestrella8/TikTok

@myriamestrella8/TikTok @myriamestrella8/TikTok

@myriamestrella8/TikTok @myriamestrella8/TikTok

@myriamestrella8/TikTok @myriamestrella8/TikTok

@myriamestrella8/TikTok @myriamestrella8/TikTok

@myriamestrella8/TikTok