The Dow Jones Industrial Average dropped 434 points today, a plunge of more than 2 percent, unnerving investors in what has been the most brutal week for U.S. markets in a decade. The S&P 500 and Nasdaq both fell at least 1.9 percent, too, and investors are concerned, particularly after Treasury Secretary Steve Mnuchin's call to bank CEOs backfired.

Mnuchin, who is on vacation in Cabo San Lucas, Mexico, held calls yesterday with the heads of the six largest U.S. banks to reassure investors that the markets are functioning properly.

A statement from the Treasury claimed that "The banks all confirmed ample liquidity is available for lending to consumer and business markets."

"We continue to see strong economic growth in the U.S. economy with robust activity from consumers and business," Mnuchin added yesterday.

Last Friday, a report that President Donald Trump was considering firing Federal Reserve Chair Jerome Powell, prompted Mnuchin and White House advisers to convince the president that he lacks the authority to fire Powell, a move seen as retaliation for Powell's decision to raise rates for the fourth time this year.

Wall Street executives, investors, and commentators say that Mnuchin's move seemed designed to generate panic.

“It signaled a sense of panic and anxiety that didn’t need to be there,” said Brian Gardner, an analyst at the investment banking firm Keefe, Bruyette & Woods. “My first reaction when I heard it was what has happened over the last couple of days that the market does not understand or realize. Is there something that Treasury knows that the rest of us don’t?”

Political commentator David Frum suggested that Mnuchin was really "collecting quotes" from those the president respects and fears "about what firing Powell would do to markets."

Others, including journalists, legislators, and legal experts, have also criticized the move.

Economist Paul Krugman provided his own characterization of Mnuchin's blunder.

As did comedian Matt Oswalt.

Stock markets have soared, in part due to loose monetary policy.

"From the 2009 low to the September 2018 highs, US stocks have gained more than 280%," writes Business Insider's Callum Burroughs, who observes: "Slowing global growth, a trade war, and hawkish Fed policy is helping usher in what looks to be a new era for stock markets."

But none of Mnuchin's interventions appear to have had an effect on the volatile president, who renewed his attacks against the Federal Reserve in a tweet earlier today.

"The Fed is like a powerful golfer who can't score because he has no touch - he can't putt!" the president wrote.

Paul H. O’Neill, who served as Treasury secretary under President George W. Bush, says that Mnuchin is ill-equipped to handle the president––or his tempestuous personality.

“The president apparently is blaming Mnuchin for the markets going south, which is a fairly strange thing,” he said.

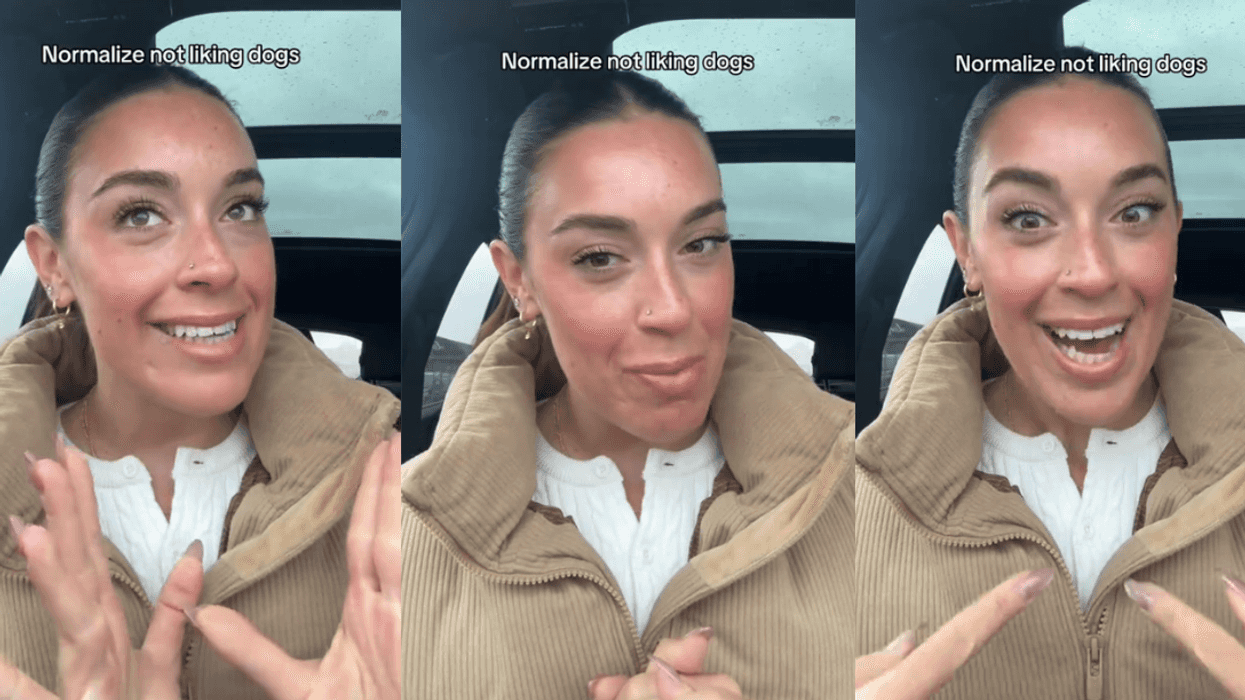

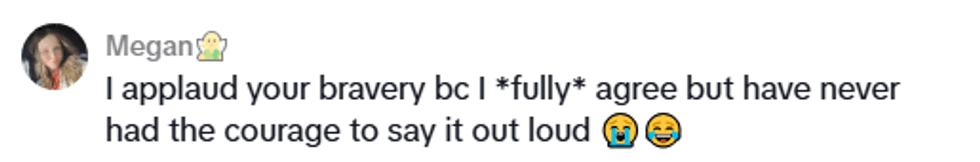

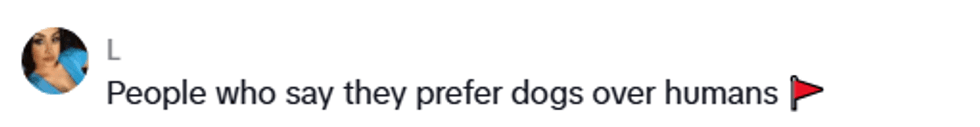

@madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok

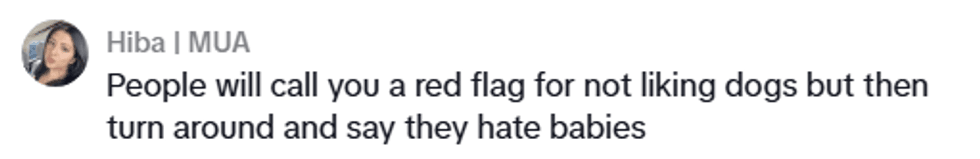

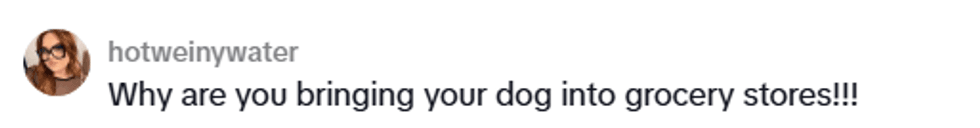

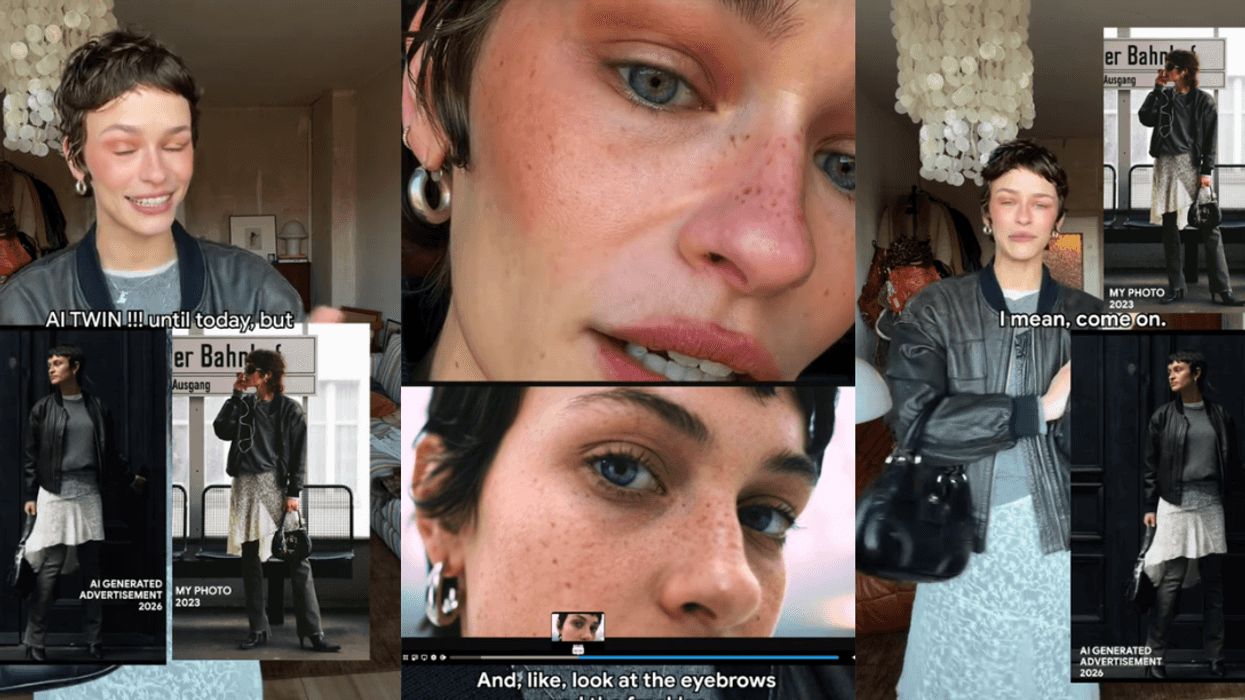

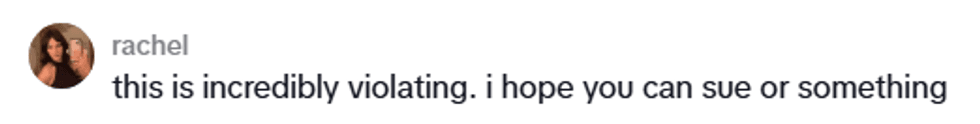

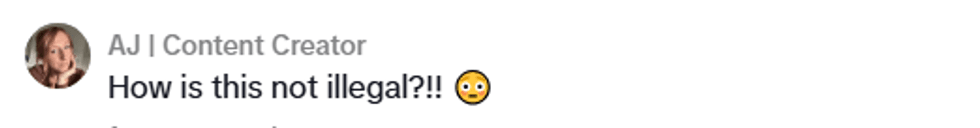

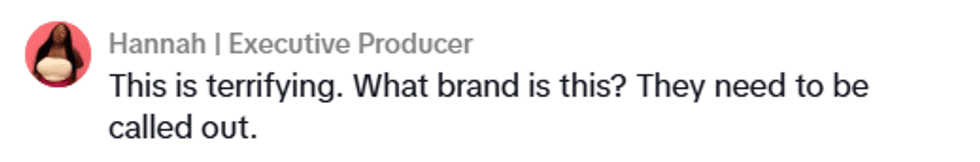

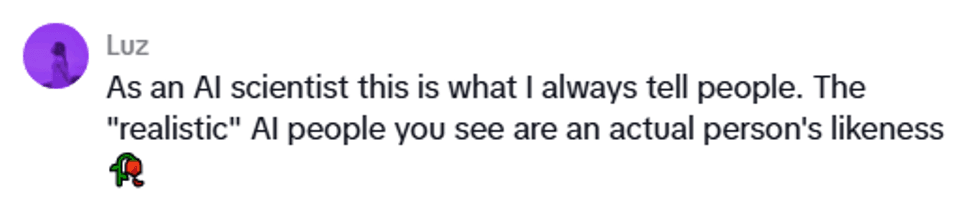

@vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok

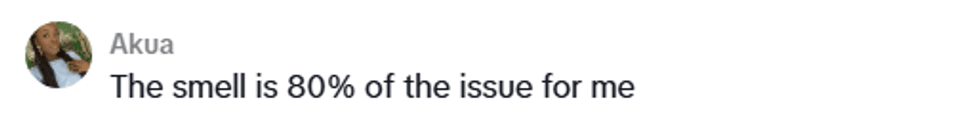

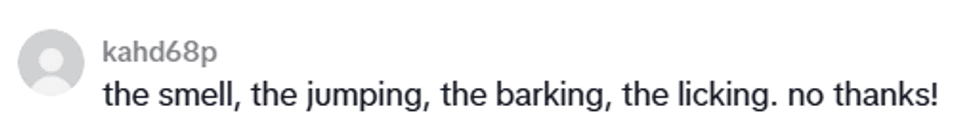

@anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok

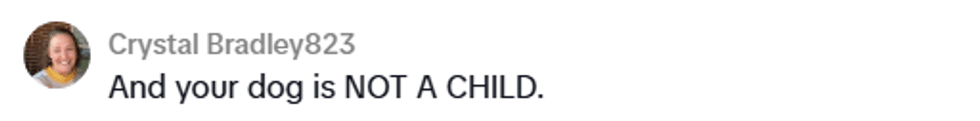

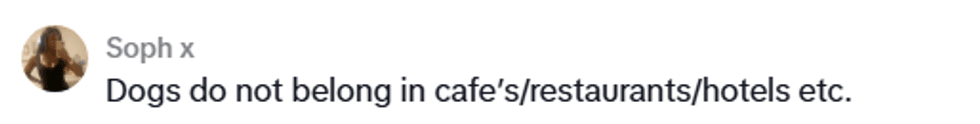

@hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok