Democrats in the House of Representatives announced on Thursday that President Donald Trump's tax returns will be the subject of a hearing scheduled two days after he gives his State of the Union address.

Vice President Mike Pence's tax returns will also be a subject of the hearing.

House Speaker Nancy Pelosi (D-CA) invited Trump to give the annual speech on the floor of the House on Tuesday, February 5.

On Thursday, February 7, the House Ways and Means Oversight Committee, chaired by Congressman John Lewis (D-GA), will hold a hearing to assess whether they have the Constitutional authority to obtain the president's financials.

The power to request the documents lies solely with House Tax Committee Chairman Richard Neal (D-MA), who has advocated a heedful approach to poking at Trump's finances.

“The president has repeatedly said on the campaign trail and then after becoming president, he intended to do this, to release them, except that he was under audit,” Neal said Tuesday. “So that’s the basis we proceed on. He added that if Trump does not agree to a "voluntary submission, then we use the legal apparatus that’s available to us.”

Technically, all Neal has to do is send a request to the IRS. But Democrats are charting a slower course, rather than issuing a subpoena, to avoid possible legal entanglements and Republican complaints about possible overreach.

Some members of the Democratic House caucus would rather seek forgiveness than permission.

“The law is very clear that we’re entitled to get those returns,” Congressman Lloyd Doggett (D-TX), who also sits on Ways and Means, said Thursday. “If the Treasury secretary... refuses to do it, then we will have to take some court action."

Either way, expect a fight from Trump and Treasury Secretary Steven Mnuchin.

As promised though, Democrats are finally going after Trump's tax returns.

Trump famously reneged on his promise to release his tax returns as a presidential candidate, becoming the first White House hopeful in 40 years to refuse to make their tax returns public.

At the time, Trump's excuse was that he was under audit, though the IRS said one has nothing to do with the other.

People are demanding change.

Trump's string of bankruptcies in the 1980s and 1990s, which was followed by a period of cash influxes from foreign interests such as Russia and entities like Deutsche Bank, add to the speculation that Trump is hiding something.

The public's interest in Trump's tax returns was rekindled last October in the wake of a bombshell New York Times report - their longest ever - which outlined decades of financial fraud and tax evasion by Trump, his businesses, and his family.

Trump "received at least $413 million in today’s dollars from his father’s real estate empire, much of it through tax dodges in the 1990s," the Times found.

Next week's hearing will also include legislation to make it mandatory for presidential candidates to release 10 years of tax returns to the public within 15 days of winning their party's nomination.

Shortly before Trump's inauguration, Representative Anna Eshoo (D-CA) introduced the Presidential Tax Transparency Act to do just that. Congressman Bill Pascrell (D-NJ) was one of the dozens of co-sponsors.

“Before 2016, presidential candidates routinely disclosed their tax returns,” Pascrell and Eshoo said in a statement. “Donald Trump refused to clear that low bar, and as a result, the American people remain in the dark about the extent of his financial entanglements and potential conflicts of interest.”

Eshoo's proposal has companion legislation in the Senate put forth by Ron Wyden (D-OR).

Similar bills have been proposed in at least 25 states.

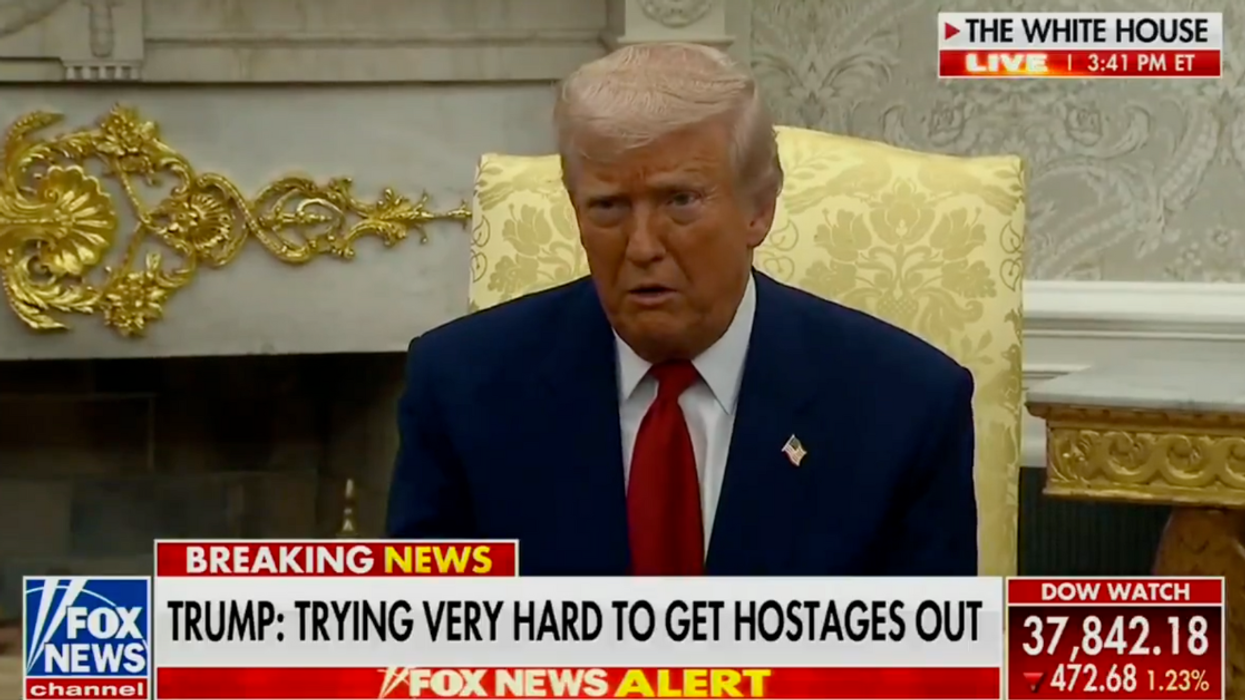

@therealjeffreyross/Instagram

@therealjeffreyross/Instagram @therealjeffreyross/Instagram

@therealjeffreyross/Instagram @therealjeffreyross/Instagram

@therealjeffreyross/Instagram @therealjeffreyross/Instagram

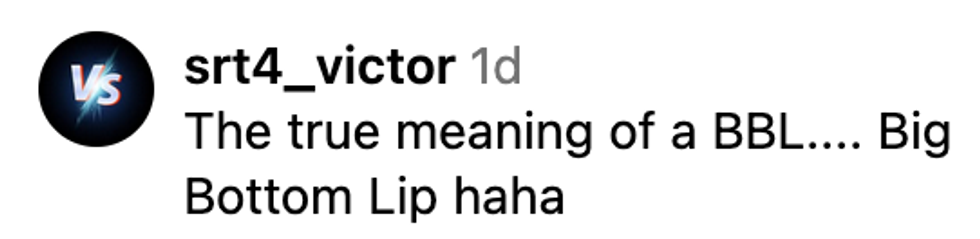

@therealjeffreyross/Instagram @therealjeffreyross/Instagram

@therealjeffreyross/Instagram @therealjeffreyross/Instagram

@therealjeffreyross/Instagram @therealjeffreyross/Instagram

@therealjeffreyross/Instagram @therealjeffreyross/Instagram

@therealjeffreyross/Instagram @therealjeffreyross/Instagram

@therealjeffreyross/Instagram @therealjeffreyross/Instagram

@therealjeffreyross/Instagram @therealjeffreyross/Instagram

@therealjeffreyross/Instagram

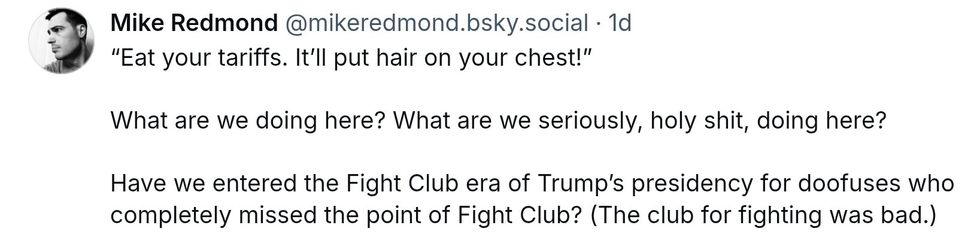

@mikeredmond/Bluesky

@mikeredmond/Bluesky

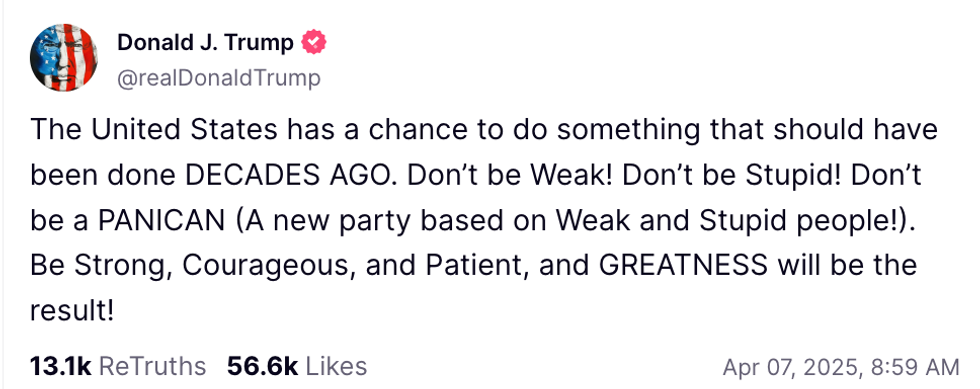

@realDonaldTrump/Truth Social

@realDonaldTrump/Truth Social