After the stock market fell a record 650 points thanks to President Donald Trump's latest tariffs, Larry Kudlow—who served as the Director of the National Economic Council during the first Trump administration—had the gall to blame the "Biden economy."

Kudlow's remarks came after U.S. stocks dropped sharply on Monday as investors prepared for Trump’s tariffs on Canada and Mexico, which took effect at 12:01 am this morning. The Dow closed down 650 points, or 1.48%, at 43,191, after falling nearly 900 points during afternoon trading before recovering slightly. The S&P 500 fell 1.76%, while the Nasdaq Composite slid 2.64%.

Additionally, the S&P 500 recorded its biggest single-day drop of the year, and the Nasdaq has fallen about 6.5% since Trump assumed office on January 20.

Kudlow said:

"The Biden economy looks like it's tanking. Tax cuts and deregulation from President Trump are so important. I sure hope we hear a lot about it in the State of the Union message tomorrow. Meanwhile, the stock market is down almost 700 points."

You can hear what he said in the video below.

Later, Kudlow, speaking to White House Press Secretary Karoline Leavitt, said:

"What's left of the Biden economy is slumping so badly, the legacy of the Biden economy. I want you to tell me, Karoline Leavitt, 'Larry, we're going to have lots of talk about tax cuts and deregulation and energy production and economic growth in [Trump's] State of the Union message tomorrow."

"I used to call it a 'growth year,' Karoline. We're going to have a growth year speech tomorrow to keep those animal spirits going. Tell me it's all true."

Leavitt replied:

"It's all true, Larry. I can confirm the president is going to talk about his economic agenda and truly, this administration is working around the clock to bring down the cost of living for the American people to deregulate the regulations that Joe Biden put on every industry across the board."

"Tax cuts are a huge priority for presidents and he'll be talking to Congress about that tomorrow night."

You can hear what they said in the video below.

After an election that was perceived as a referendum on Biden's stewardship of the economy, just a month into Trump’s presidency, public sentiment has taken a downturn. The Conference Board’s consumer confidence index has dropped to its lowest point since last June. As the organization put it, “Pessimism about the future returned.”

The index has now fallen close to the discouraging levels seen in 2022, when inflation was at its peak, and the expectations index is hovering near territory typically linked to recession concerns.

But the stats show that the Biden economy, contrary to what Trump or his surrogates might say, was the strongest the U.S. had seen in decades.

The U.S. economy’s growth in 2024 outpaced expectations. For the second year in a row, real gross domestic product (GDP)—which measures the total value of the economy adjusted for inflation—surpassed predictions from both public and private analysts.

Though many households initially struggled with high post-pandemic prices, inflation eased significantly under Biden. All indicators are pointing to a resurgence under Trump.

Kudlow was called out for his gaslighting on behalf of his former boss.

He's right: Trump is tanking the Biden economy.

— Elliott Lusztig (@elliottlusztig.bsky.social) March 3, 2025 at 4:19 PM

He's got that right. The Biden economy that was humming along is tanking now (don't ask why?).

— JoyousPanther (@joyouspanther.bsky.social) March 3, 2025 at 4:05 PM

🤣 So let me get this straight… when Biden was president, and the stock markets were going through the roof it was because everyone knew that Trump would soon be in office. Now Trump is in office and the stock markets are tanking because of Biden. Who hasn’t been in office sinceJanuary.🤔Interesting.

— NoellaRetired! (@immabeeliever.bsky.social) March 3, 2025 at 4:13 PM

Speaking about the impact of tariffs on Canada and Mexico, Trump stated that the two trading partners had “no room” left to negotiate in order to avoid the levies, adding that he was using tariffs to “punish” countries that, in his words, were taking from the U.S. economy without giving enough in return.

On Monday, Trump also signed an executive order raising tariffs on Chinese imports to 20%, up from the previous 10%. He said the increase was intended to pressure Beijing to take stronger action to curb the flow of fentanyl into the United States, arguing that China hadn’t done enough to address the issue of illegal drugs.

Following Trump’s remarks, the VIX — Wall Street’s so-called fear gauge — spiked to its highest level of the year.

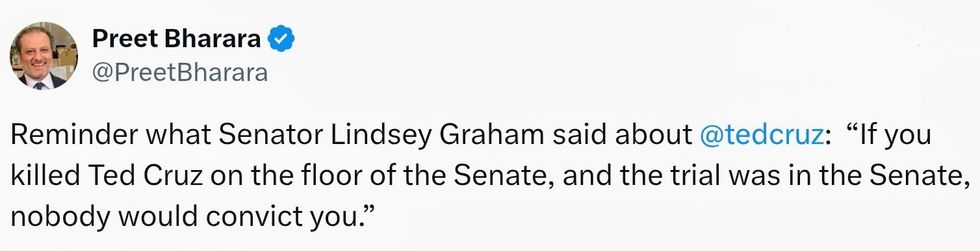

@PreetBharara/X

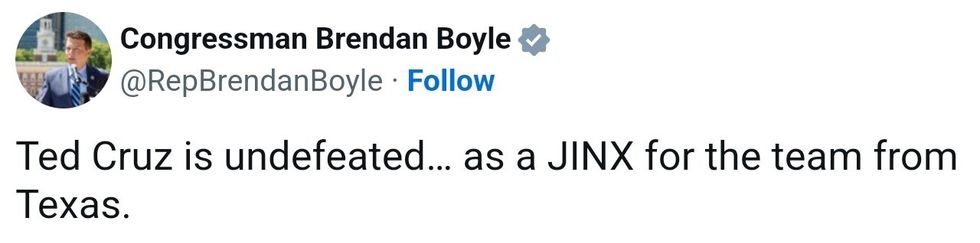

@PreetBharara/X @RepBrendanBoyle/X

@RepBrendanBoyle/X @twesq/Bluesky

@twesq/Bluesky @christopherharris/Bluesky

@christopherharris/Bluesky @evangelinewarren/X

@evangelinewarren/X

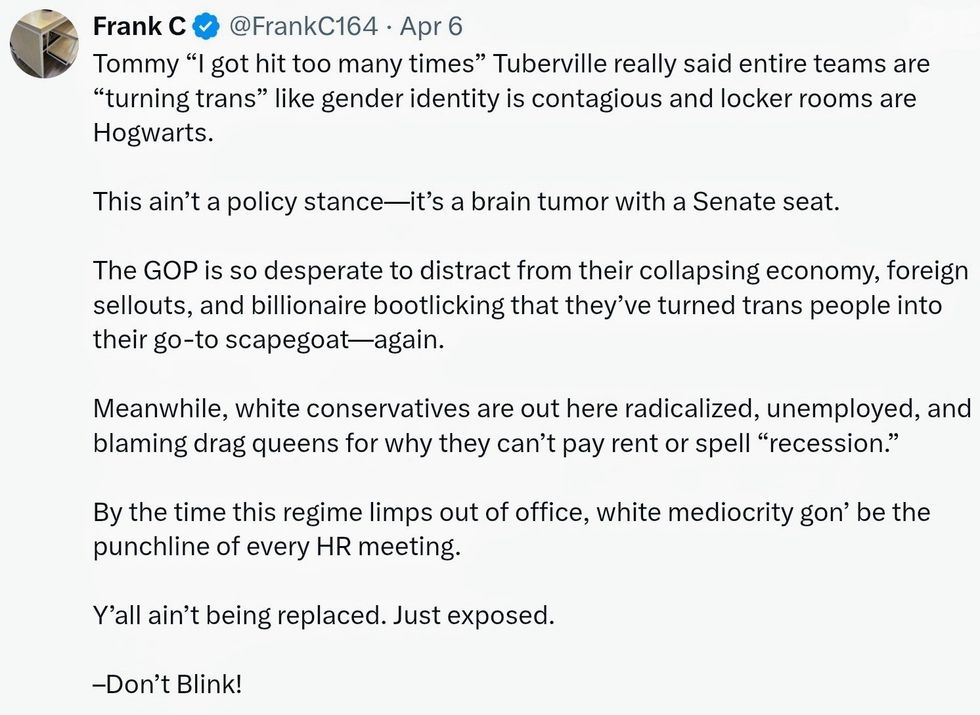

@FrankC164/X

@FrankC164/X

AMC

AMC