It seems the extremely unpopular GOP tax plan proverbially kicks a man, or in this case Puerto Rico, when they're down.

As the U.S. island territory struggles to recover from a $70 billion debt and the devastation left by Hurricane Maria, House Republicans voted for a 12.5 percent tax on intellectual property income of U.S. companies on the island and a minimum 10 percent tax on their profits in Puerto Rico. Senate Republicans passed the bill earlier Wednesday.

U.S. businesses with operations in Puerto Rico, a U.S. territory, will pay higher taxes than their counterparts on the U.S. mainland. This puts industries and jobs on the island at risk.

Tucked into the GOP’s tax reform bill, the additional tax intended to stop American companies dodging federal taxes by shifting their profits overseas. But because the U.S. tax code treats Puerto Rico as a foreign territory, business operations on the island get hit.

Puerto Rico leaders asked Republicans to exempt the island given its fragile economy. Three months after Hurricane Maria, more than 1 million Americans there still have no electricity, more than 250,000 are still without clean water, and more than 1,000 Americans died.

New York Democratic Representative Nydia Velazquez, who is Puerto Rican, warned her GOP colleagues the provision creates an “economic hurricane” upon the already battered island.

Puerto Rico is in the grip of a humanitarian crisis. Let’s be clear: Puerto Ricans are American citizens. They fight in our wars, many of them laying down their lives for our freedoms. Yet this bill continues treating Puerto Rico differently than the rest of the United States.”

Velazquez called out Speaker Paul Ryan, a Republican from Wisconsin, and Republican House Majority Leader Kevin McCarthy of California, who visited Puerto Rico after the hurricane hit and promised to help the island recover.

They looked the people of Puerto Rico in the eye and made promises to help them. This is how you help Puerto Rico?”

All House Democrats opposed the bill, as did their counterparts in the Senate.

Democratic Senator Bill Nelson of Florida spoke out against the bill in the Senate.

Puerto Rico Governor Ricardo Rossello said the tax provision would be “a huge blow”, negatively affecting 50 percent of the U.S. island’s gross national product, 30 percent of government revenue and more than 250,000 jobs.

We will analyze those who turned their back on Puerto Rico, who passed a bill that goes against the spirit of the law.”

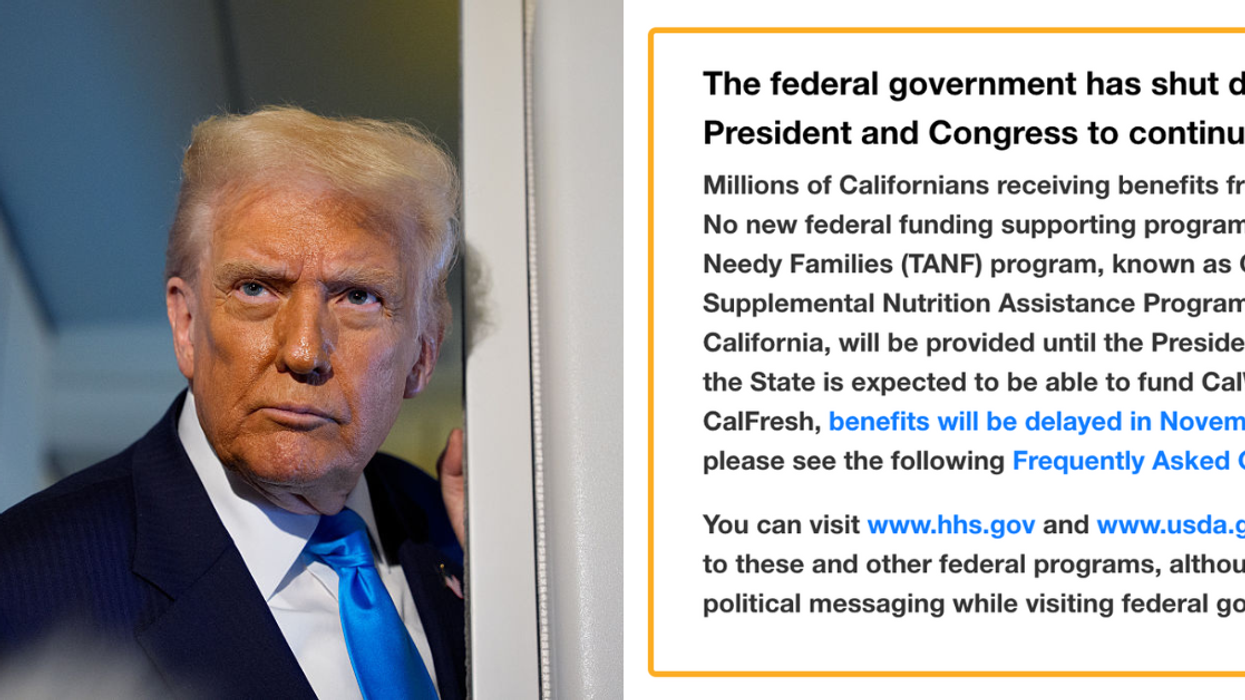

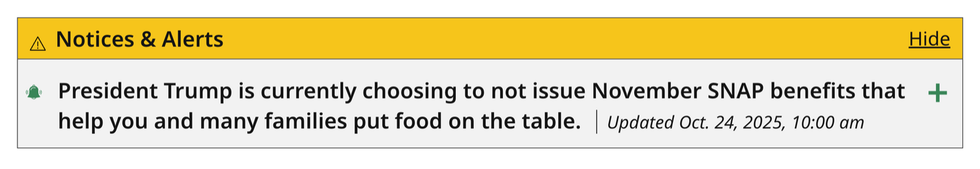

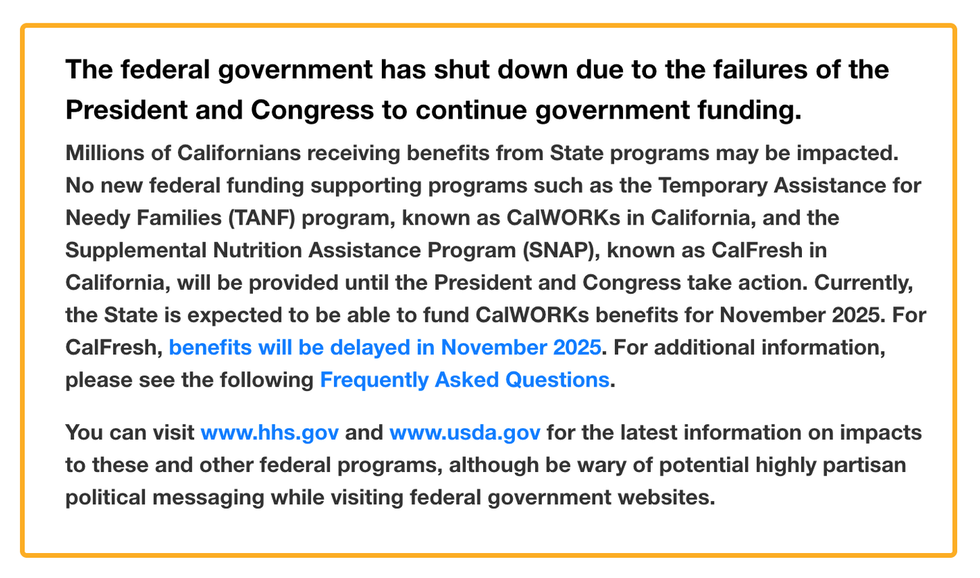

mass.gov

mass.gov cdss.ca.gov

cdss.ca.gov

Sad Break Up GIF by Ordinary Frends

Sad Break Up GIF by Ordinary Frends  so what who cares tv show GIF

so what who cares tv show GIF  Iron Man Eye Roll GIF

Iron Man Eye Roll GIF  Angry Fight GIF by Bombay Softwares

Angry Fight GIF by Bombay Softwares

@jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram