After winning a settlement from his former employer for racial discrimination, the Detroit resident went to cash the settlement check at a TCF Bank where he has been a loyal customer for nearly two years.

However, a TCF employee at the Livonia branch refused to deposit or cash Thomas' check, and instead called the police to launch a fraud investigation.

Thomas believes the reason the bank refused to help him is because he is Black.

Once again, Thomas found himself in a familiar situation.

The U.S. veteran felt humiliated as two cops interrogated him in a holding room while two other officers waited outside.

Thomas sued TCF Bank on Wednesday, citing racial discrimination.

He told the Detroit Free Press:

"I didn't deserve treatment like that when I knew that the check was not fraudulent."

"I'm a United States veteran. I have an honorable discharge from the Air Force. They discriminated against me because I'm black. None of this would have happened if I were white."

Even those who were not POC acknowledged their white privilege.

Police alleged that his check registered as fraudulent by the branch's computer system.

TCF Bank spokesman Tom Wennerberg said that the check the bank received had a watermark that read, "VOID," when scanned through a web viewer.

The appearance of "VOID" is also known as a "hidden word" technology.

"This feature makes it extremely difficult for counterfeiters to reproduce checks or documents on color copiers or scanners. The word 'VOID' appears when copied or scanned."

Wennerberg said that the bank was presented with three checks from Thomas's former employer, Enterprise Leasing Company of Detroit, in the following amounts of $59,000, $27,000, and $13,000.

"They couldn't verify that those checks were due to a settlement."

Wennerberg maintained the bank did not engage in any discriminatory behavior, but pointed out that the bank manager who assisted Thomas was skeptical about his request to deposit the two larger checks in an account that only had 52 cents.

Thomas also had asked for a new debit card because his old one was not working anymore. The latter request, according to Wennerberg, "sounded unusual."

While at the branch, Thomas contacted his employment law attorney, Deborah Gordon, so that she could authenticate the settlement check over the phone.

But the bank refused to acknowledge the legitimacy of the check.

Gordon suspected the bank treated Thomas differently because of the color of his skin.

"I got on the phone with the bank. I sent them my federal court complaint, to see that it matched. I did everything."

"Obviously, assumptions were made the minute he walked in based on his race."

She was appalled, given her client's recent ordeal dealing with discrimination.

"It's unbelievable that this guy got done with a race discrimination case and he's not allowed to deposit the checks based on his case? It's absolutely outrageous."

"They could have just called the bank that issued the checks, and they apparently didn't do anything because it would have all been verified immediately."

Wennerberg also added that the bank manager who waited on Thomas happened to be African American, and that she called the police because something "didn't look right."

Thomas was not arrested, nor were any charges filed.

But he remained calm despite being afraid during the situation.

"I feel very intimidated because I knew that if I would have gotten loud, they would have had me on the ground for disturbance of the peace."

"But I didn't get loud … I did nothing."

Thomas closed his account with TCF Bank that day and walked over to Chase Bank to open an account with them.

He then deposited his checks into his new account and money was made available to him within twelve hours.

The vet – who does not own a car and walks to work – used the cash to buy a 2004 Dodge Durango.

On Thursday, TCF bank issued a statement of apology.

"We apologize for the experience Mr. Thomas had at our banking center. Local police should not have been involved."

"We strongly condemn racism and discrimination of any kind."

"We take extra precautions involving large deposits and requests for cash and in this case, we were unable to validate the checks presented by Mr. Thomas and regret we could not meet his needs."

Thomas' case is similar to another incident involving racial discrimination in which an indigenous man and his 12-year-old granddaughter claimed they were racially profiled while trying to open an account at a Bank of Montreal in Vancouver back in December.

For more about institutional racism, listen to George Takei's Oh Myyy Pod podcast episodes "Napping While Black" and "White Fragility."

@obamaatredrobin/X

@obamaatredrobin/X

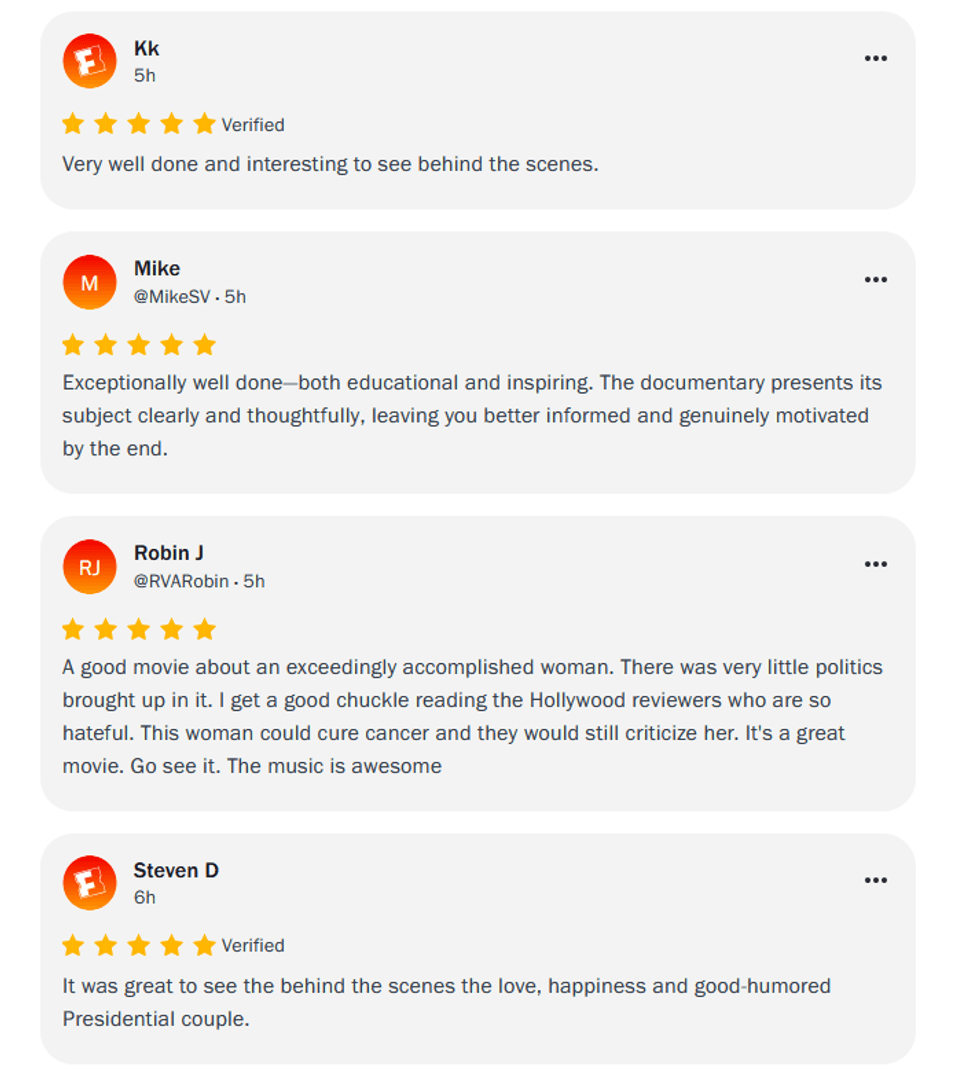

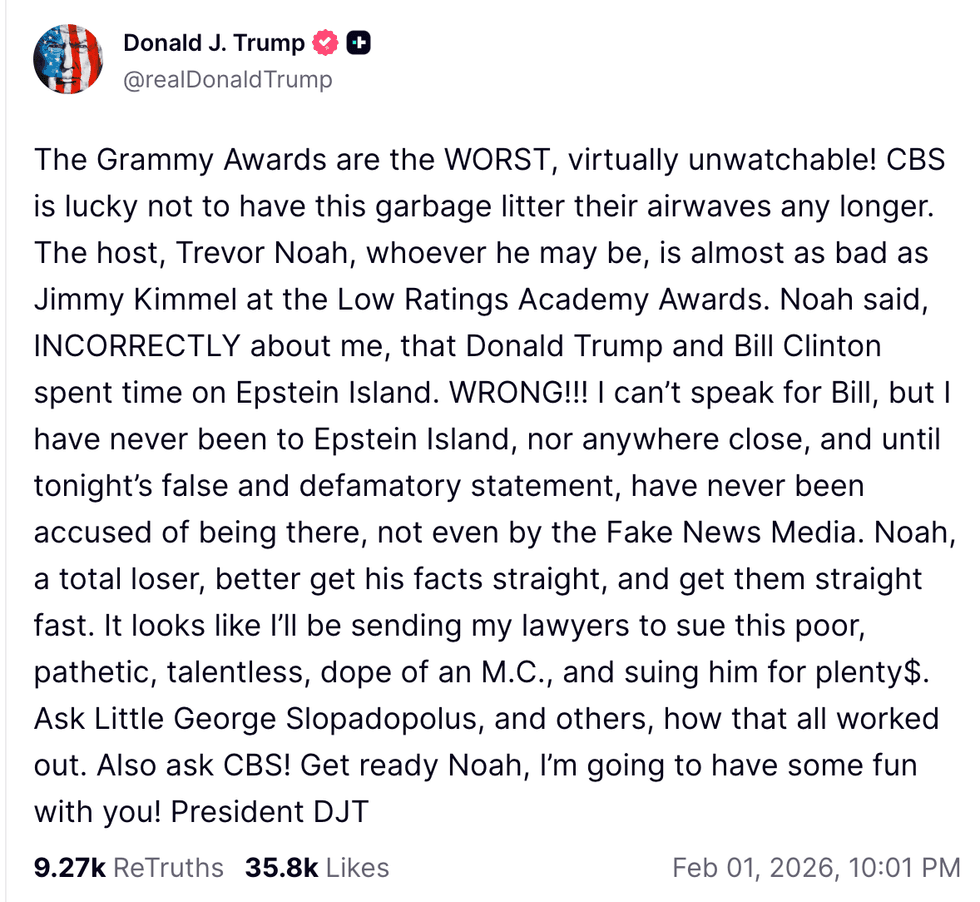

@realDonaldTrump/Truth Social

@realDonaldTrump/Truth Social

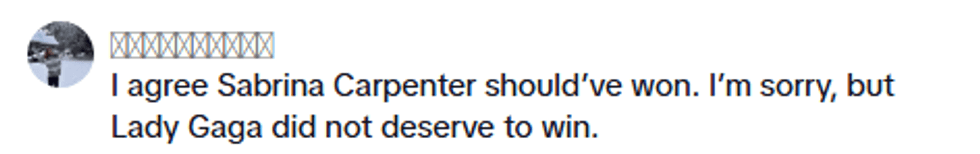

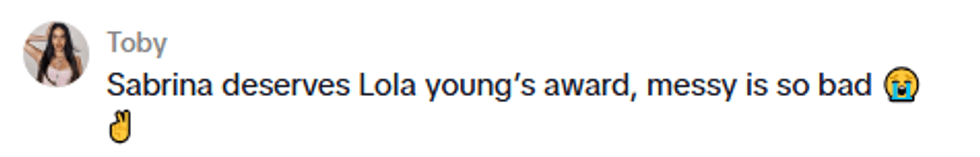

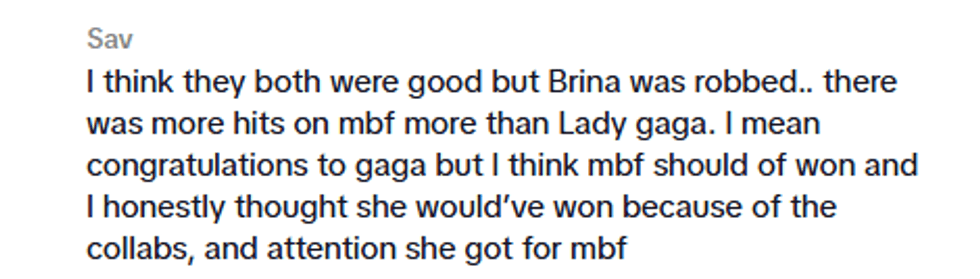

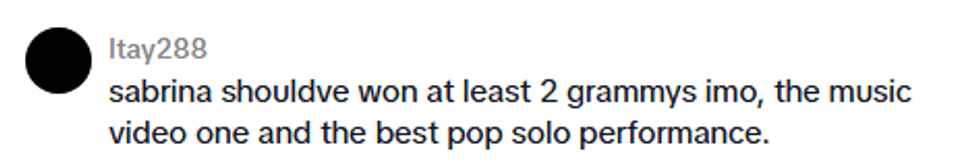

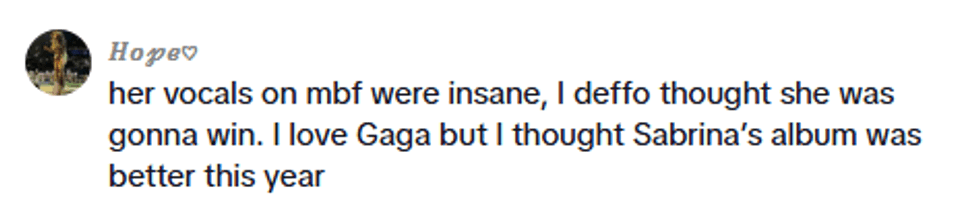

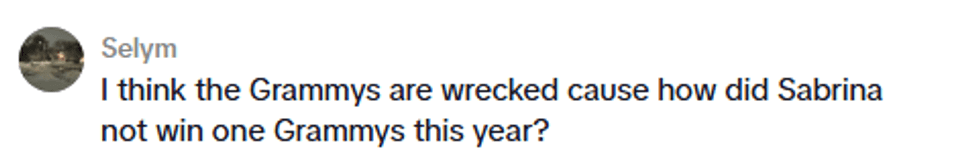

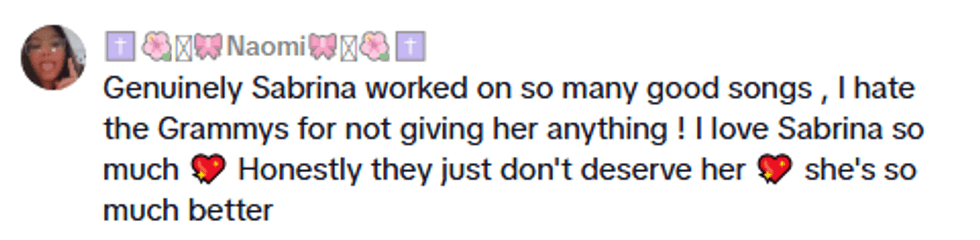

@.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok